Hsa-based health Plans

Key aspects of HSA-based health insurance.

Two Part Healthcare.

The most important thing to understand about HSA-based health plans is that they have two parts: health insurance and health savings accounts (HSA).

Protection.

The insurance component of an HSA-based health plan protects individuals from high, unexpected medical costs, and covers preventive care at 100%.

Protection.

The insurance component of an HSA-based health plan protects individuals from high, unexpected medical costs, and covers preventive care at 100%.

HSA Access.

Money, including premium savings, can be deposited tax-free into an HSA to pay for current or future qualified medical, dental, or vision expenses for you and your dependents.

Advantages.

Lower monthly premiums, tax advantages, covered preventive services, and coverage for routine and major medical expenses are the main advantages of an HSA-based health plan.

Advantages.

Lower monthly premiums, tax advantages, covered preventive services, and coverage for routine and major medical expenses are the main advantages of an HSA-based health plan.

Power to grow.

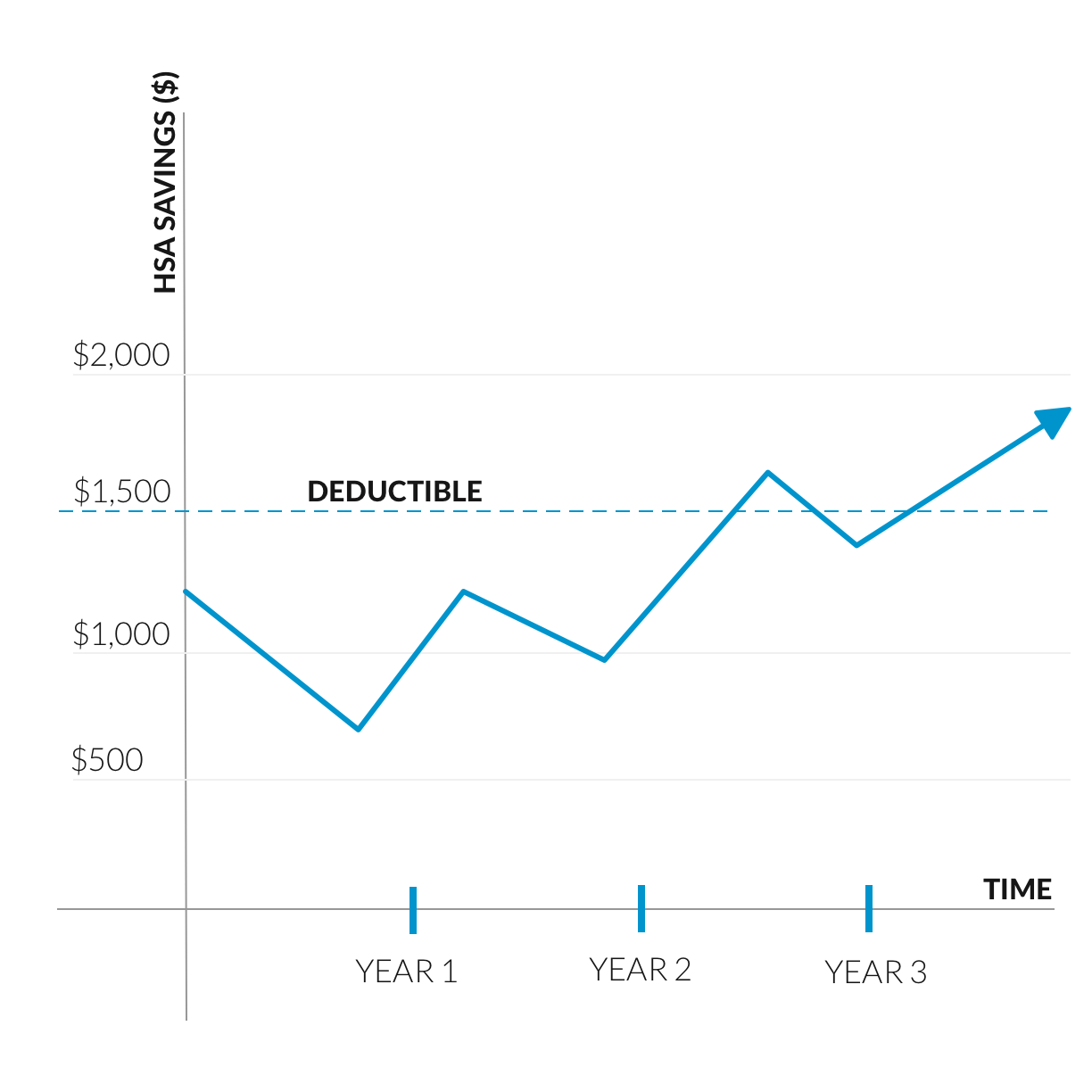

Consider this… if your previous plan had a $500 deductible with co-pays and you moved to a $1,500 deductible plan and saved $100 a month, the $100 saving could be put into an HSA… that is $1,200 a year that is now your money.

If you had $700 of medical expenses you would “roll over” $500 in your HSA into the next year. If the same scenario happened the following year you would roll over another $500 for a total HSA balance of $1,000. If this scenario played out year over year by year 3 you would have the money in your HSA to cover your deductible. This could never happen in a co-pay plan because no matter how much you spend, you never roll any money over.

MotivHealth Insurance Company

![]() 844-234-4472 | MEDICAL

844-234-4472 | MEDICAL

![]() 385-247-1030 | PHARMACY

385-247-1030 | PHARMACY

![]() 385-308-4400 | EMPLOYERS

385-308-4400 | EMPLOYERS

![]() 385-308-4410 | MOTIVNET – Contract

385-308-4410 | MOTIVNET – Contract

![]() 10421 S Jordan Gateway, Ste. 300

10421 S Jordan Gateway, Ste. 300

South Jordan, UT 84095

Copyright © 2024 MotivHealth Insurance Company. All Rights Reserved.